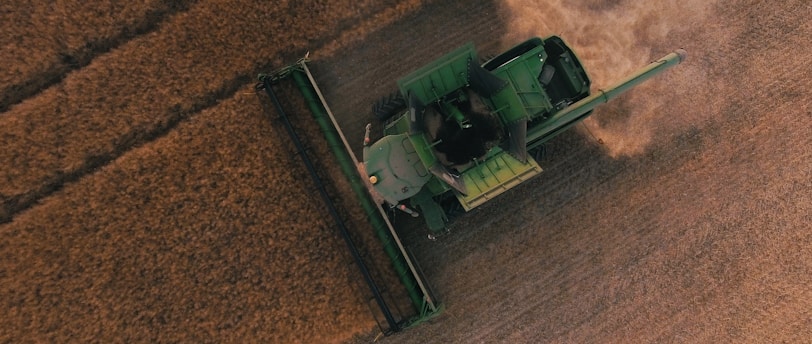

Farming Case Study Nº30

1/17/20243 min read

Brief:

A father and son work a farm together. At present the father is a sole trader and pays the son for his work. The son also has a house on the farm which he lives in rent free. The father is nearing retirement, as he see’s it between 3 and 5 years until he stops working completely. The son is keen to takeover the day to day running of the farm and implement more modern practices. The father who was previously a farm hand on this farm for 20 years purchased the farm when with the sale of the family house and family money left to him by an uncle. He saw it as an investment, with the aim being to have generations work the land ensuring his legacy in the community and is therefore more than happy to gradually transfer the farm to his son, however he would like to maintain a small income for his help in his retirement.

Primary reason for structure in numerical order:

Legacy preservation

Tax efficiency

Asset protection

Wealth management

Proposal:

A Family Investment Company (FIC) was formed with eight classes of shares & director loan:

A. Voting shares, nominal value common shares with all the voting rights

B. Redeemable preference shares to be issued to reflect the current asset value

C. Redeemable preference shares to be issued to reflect the capital contributions

D. Growth shares to hold the future value over the current asset value

E. Nominal value dividend shares for the father to receive a dividend during retirement

F. Nominal value dividend shares for the son to receive a dividend

The FIC was formed with all the 1000 x £1 voting shares being issued to the father therefore controlling 100% of the FIC, these being of nominal £1 value can be sold for £1 each or gifted to the wife, son or daughter tax free.

A subsidiary company was formed with only 100 common shares all held by the FIC, this would be the entity that with hold the legal titles to the properties once the conveyancing was completed.

The FIC then agreed to exchange the £Xm worth of property in the 9 folios (Main farmhouse with barns, cottage and 7 parcels of land) for £Xm worth of fixed value redeemable shares in the FIC, split £Xm of class B and £Xm of class C.

This exchange of shares is not monetary, therefore there is not Stamp Duty Land Tax (SDLT) on the transfer once completed. It is also important to note the value of the father’s estate was not gaining or losing, there is no capital gains tax either, as the capital gain is rolled into the shares of the FIC.

A further subsidiary company were formed 100% owned by the FIC, one to manage the farm with father and son as directors, with all the machinery, equipment etc being moved into the company once any finance was cleared.

Both where directors of the FIC and subsidiary holding the properties, with an uncle have power of attorney in case the father died before the son was able to take over the farm fully. The father had control of the voting shares; he had the final say on any major financial decisions about the company like when to the payment of dividends to any class of shares.

A discretionary trust was formed to hold the class D shares (Future Growth shares) for the grandchildren and future generations, which is expressed via the letter of wishes as well. The father, son plus an uncle are the trustees, these shares have nominal value today are gifted tax free. There is also a shareholder agreement put in place in case of any future disputes or divorce to prevent any shares being sold outside the family.